Contents

Not So Common Fixed-Income Preview – In this article, I’ll review the less popular fixed-income securities. After looking at the charts above in the article, with the constantly increasing LIBOR rate, their 4.80%-5.30% current yield.

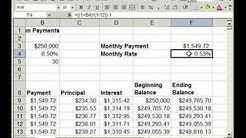

View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your. Sat 8 a.m. – 6:30 p.m. ET. Other ways to contact us. Talk to.

Recharged bulls give stocks, commodities flying start to year – Oil has raced up 30 percent, which is its best performance in any quarter since 2009. That has also helped Russia’s rouble.

How to save yourself when you work in fixed income trading at Goldman Sachs – As the chart below shows, the worst performer was Morgan Stanley, whose fixed income revenues fell 30%. the bank has reduced expenses in its FICC business by 30% in the past three to five years,

VCSH Performance & Stats – YCharts – In depth view into VCSH (Vanguard Short-Term Corporate Bond ETF) including performance, dividend history, holdings and portfolio stats.

No Pmi Loans No Pmi Loans – No Pmi Loans – Looking for refinancing your mortgage loan online? Visit our site and learn more about our easy loan refinancing options. how to take home loan home equity loan monthly payment calculator why refinance a home.

30 Yr Fixed Mortgage Rate Chart – You’re looking for an easy way to refinance your mortgage payments? Visit our site to learn more about our refinancing terms.

Fixed Deposit beats Mutual Funds in 2018 – 2018 was a rough year for investors in India. On one hand, those who had put money in safe bets like fixed deposits (FDs. had gained 29.58% and Nifty 30.28%. Overall, equity mutual funds.

Fha Conforming Loan Limit FHA Loan Limits For 2018 – The FHA’s floor is currently set at 65% of the national conforming mortgage limit, which recently increased from $424,100 to $484,350 for 2018. As a result, this increases the FHA limit $275,665 to $294,515 in most counties nationwide.Advantage Of Fha Loan FHA 203k loans are designed to help borrowers finance an older home that needs significant repairs. To get an FHA 203k loan, you must work with an FHA-approved lender. You will also have to provide a detailed proposal of the work you want to do.

Fixed Rate Preferred Stocks – Complete Review – As we can see in the chart below, half of the PFF’s market capitalization consists of fixed-rate preferred stocks. announcement last Wednesday (January 30, 2019) after the two-day meeting. After.

Fixed Rate Preferred Stocks – Complete Review – As we can see in the chart below, half of the PFF’s market capitalization consists of fixed-rate preferred stocks. announcement last Wednesday (January 30, 2019) after the two-day meeting. After.

Average 30 Year Fixed Mortgage Rates – Mortgage News Daily – Founded in 2004, Mortgage News Daily has established itself as a leader in housing news, analysis and data. Our innovative social media platform combines industry leading content and data with an.

fha vs conventional refinance FHA vs Conventional Loans: Which Mortgage is Better for You? – FHA and conventional loans also have different mortgage insurance guidelines. You will have to pay insurance every month if you are unable to put 20% down. FHA Loans. You pay two types of mortgage insurance on FHA loans. First, you pay upfront mortgage insurance. You pay this at the closing. Today, it equals 1.75% of the loan amount.

GDBR30 Quote – German Government Bonds 30 Yr Dbr Index. – Index performance for German Government Bonds 30 Yr Dbr (GDBR30) including value, chart, profile & other market data.

1-Year Fixed Mortgage Rates – RateHub.ca – 1-year fixed mortgage rates defined. The mortgage term, in this case one year, is the length of time your mortgage rate is in effect. If you select a 1-year fixed rate, you will be able to select a new mortgage type, provider and associated mortgage rate at no penalty come the end of the year.

ANTIPSYCHOTIC COMPARISON CHART – DBSA San Diego – ANTIPSYCHOTICS: Frequently asked Questions. 1. What is the difference in WEIGHT GAIN among the different antipsychotics?1 Estimated weight change at

Mortgage rates slide the fastest in four years, but it may be too late for the housing market – The 30-year fixed-rate mortgage averaged 4.81% in the November 21 week. according to the Mortgage Bankers Association. As the chart above shows, they’re now lower than year-ago levels by double.