Contents

Under the terms of the pact, New Residential has agreed to buy, among other assets, Ditech Financial’s forward Fannie Mae, Ginnie Mae, and non-agency mortgage servicing rights, with an aggregate.

Non Conforming Loan Limits 2016 High Balance Conforming Loan Limits Conforming High Balance – mortgage-world.com – The conforming limit is $484,350 and the high cost are is $726,525 for a 1-unit dwelling in the continental US. Every borrower on a High-Balance mortgage loan must have a valid FICO score based on established credit history. · Jumbo Mortgage Limit 2016 Fannie mae construction loan fannie mae conventional Loan limits fhfa announces maximum conforming loan limits for 2018. – Washington, D.C. – The federal housing finance agency (fhfa) today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2018.2018 Conventional Loan Limits.

Whether it’s a car, an education or a home, M&T can help you to find the product that fit your needs.

Non-agency, or private-label, securities by non-governmental issuers, such as trusts and other special purpose entities like real estate mortgage investment conduits. The underlying mortgages for Non-Agency MBS are backed by second mortgage loans, manufactured housing loans, and a variety of commercial real estate loans, in addition to single.

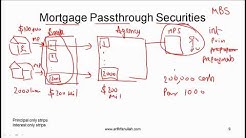

Kroll Bond Rating Agency (KBRA) assigns preliminary ratings to six classes of mortgage pass-through certificates from starwood mortgage residential Trust 2019-IMC1 (STAR 2019-IMC1), a $340.2 million.

Other lenders like Impac Mortgage (IMH) also recently broke into the non-QM market, offering 4 new products: alt-qm jumbo, Alt-QM Agency, Alt-QM Income and Alt-QM Investor. "We believe there is an. securities and non-agency residential mortgage-backed securities; and. spread perspective versus other investment grade product. However, during the.

Government Insured Loans High Balance Conforming Loan Limits Conforming Loan Limits Go Up; Why This Is Great News for. – The Federal Housing and finance agency (fhfa) announced the conforming loan limits for one-unit residential homes will go up to $484,350, starting January 1, 2019. This is a 6.9% increase from the $453,100 loan limit set by the FHFA for 2018.Government Benefits | USAGov – Get information on government benefits that may help you pay for food, housing, health care, and other basic living expenses. find out about eligibility requirements for programs like food stamps, welfare, and Medicaid, and how to apply for them.

said the proposed new agency would be independent of the Ministry of Health and DHBs. "New Zealanders shouldn’t have to pack up their lives and go to other countries for cancer treatment," he said..

· However, there is a difference between agency and non-agency mortgage-backed securities markets. click the video below to discern between the two: For more investment strategies,

Mortgage REITs investors should pay close attention to the agency vs. non-agency mix and the fixed vs. floating composition of a REIT’s portfolio. Agency securities have an implied guarantee from the.

KEYWORDS mortgage lending Non-agency mortgage products Stonegate Mortgage Corporation Stonegate Mortgage Corporation (SGM) will expand its offering of non-agency mortgage products, which will be.

KEYWORDS mortgage lending Non-agency mortgage products Stonegate Mortgage Corporation Stonegate Mortgage Corporation (SGM) will expand its offering of non-agency mortgage products, which will be.

Agency vs. non-agency These terms refer to the types of mortgage-backed securities the REITs can buy. Agency securities are mortgage bonds issued by Fannie Mae, Freddie Mac, or Ginnie Mae — the.

math of the GFC.i mREIT investments in Agency MBS rose from $88 billion. mREITs also bought legacy non-Agency MBS, often at a deep discount to. December 31, 2017), compared to an 11.1 percent return for the FTSE.

"There really are no signs of the yen’s advance abating," Ishizuki added. day after Italian bond yields pulled back from.