Contents

This is the amount you pay upfront toward your home purchase. typically, the recommended amount is 20% of your purchase price. Under certain loan programs, a down payment amount may be as low as.

This is the amount you pay upfront toward your home purchase. typically, the recommended amount is 20% of your purchase price. Under certain loan programs, a down payment amount may be as low as.

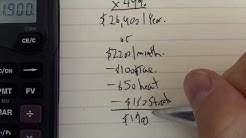

To determine how much house you can afford, use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile. Generally, lenders cap the maximum monthly housing allowance (including taxes and insurance) to lesser of Front End Ratio (28% usually) and Back End Ratio (36% usually).

See how much you can afford to spend on your next home with our Affordability Calculator. Calculate your affordability to see what homes fit into your budget. Rent. Post A Rental listing. mortgage. mortgage overview Get Pre-Qualified mortgage rates refinance rates.

How Much House Can I Affort When you own a home, mortgage rates become a key part of your monthly payment for your house. Mortgage rates affect how much home you can afford. If today’s mortgage rates are down, the amount of home you can afford will rise. If today’s mortgage rates are.

That way you can gauge where you can place yourself in terms of the salary you will ask for. Identify your value as an employee based on your experience. which is the true picture of how much.

Do you earn enough money to buy the home you want? By entering just a few data points into NerdWallet’s mortgage income calculator, we can help you determine how much income you’ll need to qualify.

so we needed to completely live off my salary. That’s when we moved from our rented flat in Shepherd’s Bush in London to my.

4 Different Rules of Thumb For How Much House You Can Afford.. such that you calculate affordability of a house based on a single income. The LA Times pointed out in a really interesting series on "economic risk", that in the past, when a family lived under one income, if that income was.

Should A Single Person Buy A House

This way, you will not only be able to automate payments, but also control how much you spend on your credit card. modify.

The 30: The 30 represents how much of your income should go to discretionary spending. basically, you should allocate 30% of your monthly income to cover entertainment, dining, the gas needed for out of town trips, the costs of your hobbies, and anything else that you can live without if you had to.