Contents

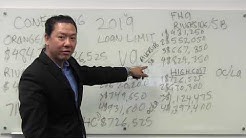

As of 2019, the conforming loan limit is $484,350 in most locations throughout the U.S. Select areas of California, Florida, Virginia, DC, Colorado, etc are deemed “high cost” and allow for conforming loan limits up to $726,525. Any loan amount that exceeds the conforming mortgage limit is considered a Jumbo mortgage.

Shashank Shekhar 1-855-644-LOAN email; Best-selling author, Shashank Shekhar is the CEO of Arcus Lending, offering mortgage loans for home purchase and refinance. For a free consultation and/or rate quote email him at Shashank@ArcusLending.com or call his office at 1-855-644-LOAN.. Buy his new best-selling book "My First Home – a step-by-step guide to achieving the ultimate American dream" on.

. amounts greater than $625,500 are referred to as jumbo’ loans and carry stricter underwriting guidelines. Our neighbor, Monterey County, for example, does not enjoy the maximum loan limit offered.

More borrowers now need jumbo loans to buy or refinance homes. You can find the maximum conforming loan limits for your state and county at the Federal Housing Finance Agency. The higher limit was.

Fannie Mae Mortgage Requirements Fannie Mae’s mortgage products support sustainable homeownership by allowing: Low Down Payment and Flexible Sources of Funds. Conventional home financing with private mortgage insurance (pmi) that, unlike many government-insured loans, may be eligible for cancellation when home equity reaches 20%.

When a mortgage is in the zone between $417,000 and a high-cost county’s upper limit, it’s called a "jumbo conforming," "super conforming" or "high-cost area conforming" loan. The jumbo conforming.

In high-cost areas like Santa Clara and San Mateo counties and most counties in the Bay Area, the cap will be $636,150, up from the previous loan limit of $625,500. Maximum loan limits for 2017 are up.

On this page, you can view 2019 conforming loan limits by county. You can download them in either PDF or spreadsheet format, for convenience.

VA Jumbo loans allow for financing above the VA county loan limit. For purchases, the VA allows for 100 percent loan-to-value up to the county loan limit.

VA Jumbo loans allow for financing above the VA county loan limit. For purchases, the VA allows for 100 percent loan-to-value up to the county loan limit.

or those below the limit, generally are about 0.25 of a percent lower than jumbo loan rates, according to mortgage news daily. The median price of an existing single-family house was $665,000 in.

Threshold For Jumbo Loan how much is a conforming loan Conforming Loans – Hancock Mortgage Partners – Conforming loans are conventional loans that meet bank-funding criteria set by. establish limits on what constitutes a conforming loan in a mean home price.Are you planning to apply for a loan higher than the conventional loan limit? American Loans helps you find the best Jumbo loan options.

A Jumbo mortgage is a home loan that exceeds the standard loan limits set by the Federal Housing Finance Agency’s limits.A home must meet appraisal guidelines and.